Frozen

Hunkered down in South Texas while waiting for “The Big Freeze of 2021,” we found ourselves in the kitchen cooking and reflecting on what our country has been through over the last twelve months. After an appetizer of fresh COVID-19, we had seared election with impeachment reduction sauce, accompanied by a palate-cleansing South Texas sorbet. In wondering, “What’s next?” we lamented that the main course never seems to change: another serving of divided country with a side of uncertainty.

After-dinner reading steered the conversation toward what always seems to matter most in the US today: government. Does government’s ever-increasing importance to society reflect the possibility that it is already too big and too pervasive? Or should it be larger as it strives to do more? How does this affect the country and the markets? Our readings included an article by Larry Summers, former director of the National Economic Council for President Obama. Summers offered cautionary statements about the potential for inflation in President Biden’s prospective $1.9 trillion COVID-19 relief bill, not to mention the possible $2 trillion-plus infrastructure bill to follow. Alternatively, Janet Yellen and Jerome “Sir Printsalot” Powell recommended that now is the time to “go big or go home.”

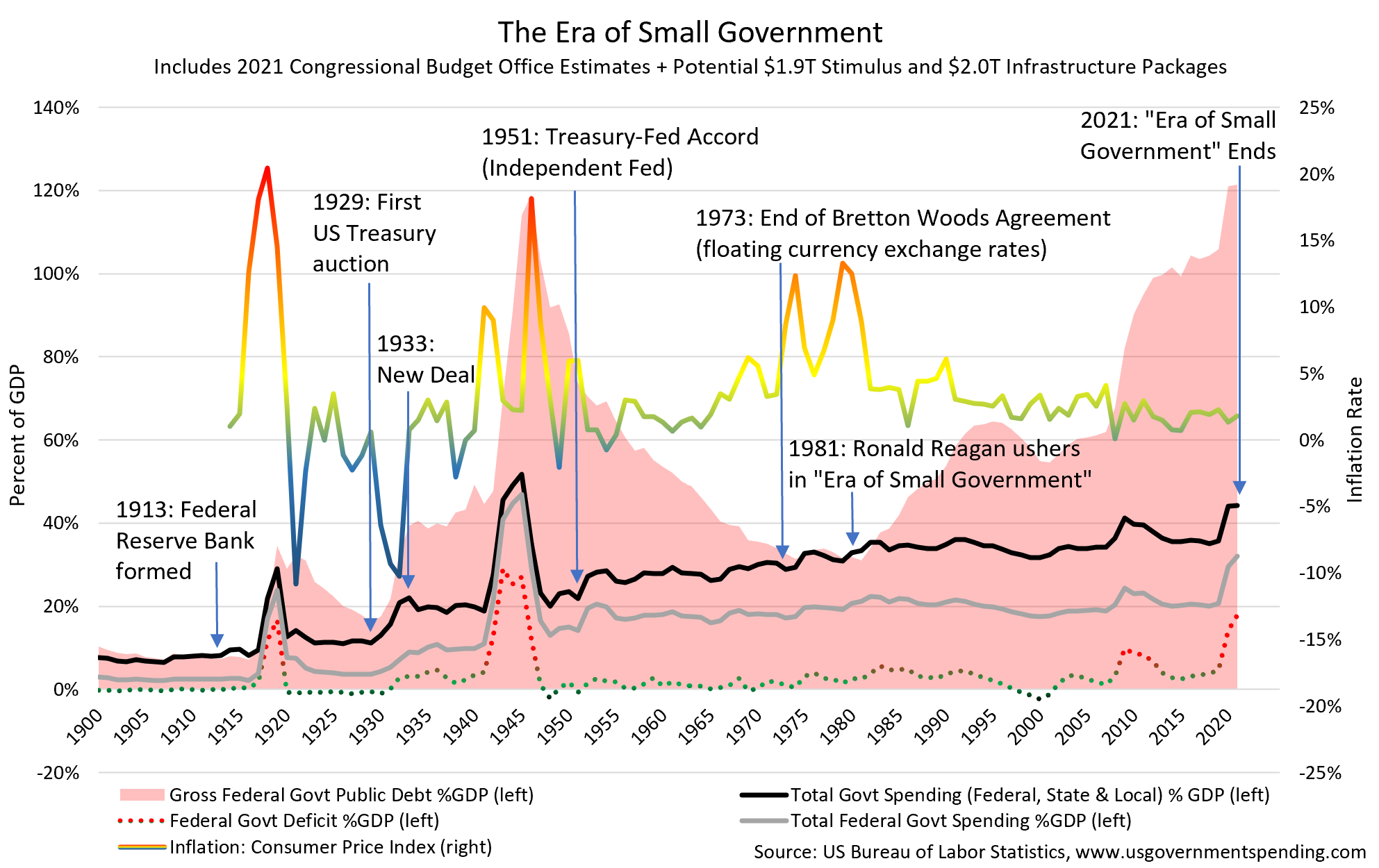

Evaluation of the best policy was not our intent, but rather discerning which policies will be implemented and how investment fundamentals and investors might respond. The country’s divisions are not just about policies but about facts; many are unable even to agree on what the facts are, let alone the solutions. Perhaps the best reflection of today’s zeitgeist is a recent Washington Post opinion piece by Katrina vanden Heuvel, former editor/publisher of The Nation magazine, entitled “At long last, a president declares that the era of small government is over.” The celebration of larger government is not unique among many in our country. However, we find the assertion of having just completed a period of small government to be questionable in light of the last 120 years of economic history.

The 1980s may have initiated an era where many wished or fought for small government, even somewhat succeeding in slowing the growth of government. But an actual era of small government in recent history? No. None of the economic recoveries in the past century have led to a sustained decrease in the size of government as a percentage of GDP. In fact, over the last 100 years, government spending as a percentage of economic activity has trended steadily higher from 8% to over 40% today. Historically, economic studies of the “optimal” level of government spending recommend a range of 10-25%, averaging about 18%. Any tether to that research is now lost as Washington seems even less interested in budgetary prudence.

Please note that the chart above assumes the $1.9 trillion COVID-19 relief package, along with another $2 trillion for infrastructure, will be approved. Without that spending, the end result is still among the largest ever. Either way, 2019 and 2020 saw the federal government move from crowding out, to controlling, to effectively being the market in some areas—a market otherwise deprived of liquidity because of the government’s need for money to spend. The Federal Reserve now controls much more than just the Fed Funds interest rate as it camouflages the market’s growing inability to handle the government’s demand for funds. We fully expect more draconian steps this year that potentially include an overt policy on direct yield curve controls.

It is not a matter of if, but when Mr. Market will object. Musical chairs, anyone?